Get the free naic biographical affidavit

Show details

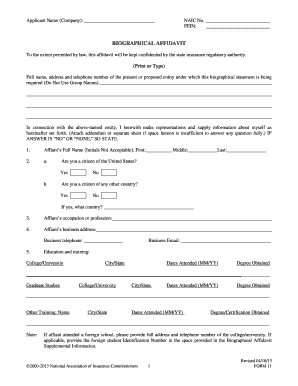

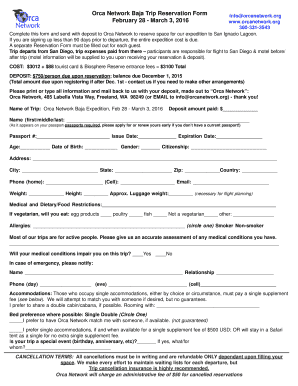

Applicant Name Company NAIC No. FEIN BIOGRAPHICAL AFFIDAVIT To the extent permitted by law this affidavit will be kept confidential by the state insurance regulatory authority. Print or Type Full Name Address and telephone number of the present or proposed entity under which this biographical statement is being required Do Not Use Group Names. In connection with the above-named entity I herewith make representations and supply information about myself as hereinafter set forth. Attach addendum...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign current naic biographical affidavit form

Edit your naic biographical affidavit fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your naic biographical affadavit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit naic biographical affidavit pdf online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit biographical licenses employers form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out regulatory affidavit biographical form

How to fill out NAIC Biographical Affidavit

01

Obtain a copy of the NAIC Biographical Affidavit form from the NAIC website or your state insurance department.

02

Fill in your personal information such as name, address, date of birth, and Social Security number.

03

Provide information about your employment history, including employers, positions held, and dates of employment.

04

Disclose any criminal history, financial issues, or regulatory actions as required by the form.

05

Sign the affidavit in the designated area to affirm that the information provided is accurate.

06

Submit the completed affidavit to the appropriate regulatory authority as instructed.

Who needs NAIC Biographical Affidavit?

01

Individuals applying for a license to operate in the insurance industry.

02

Officers and directors of insurance companies.

03

Certain key employees at insurance firms who are involved in management or oversight.

Video instructions and help with filling out and completing naic biographical affidavit

Instructions and Help about naic biographical affidavit fill

Fill

fillable naic blank form

: Try Risk Free

People Also Ask about naic biographical affidavit form

What is the NAIC and what is its purpose?

The National Association of Insurance Commissioners (NAIC) provides expertise, data, and analysis for insurance commissioners to effectively regulate the industry and protect consumers.

Is the insurance industry regulated by the federal government?

Insurance is regulated by the states. This system of regulation stems from the McCarran-Ferguson Act of 1945, which describes state regulation and taxation of the industry as being in “the public interest” and clearly gives it preeminence over federal law. Each state has its own set of statutes and rules.

Is the NAIegulator?

The National Association of Insurance Commissioners (NAIC) is the regulatory body that governs all things insurance — it sets standards, establishes best practices, and conducts oversight of the insurance industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the applicant business electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your applicant information description in minutes.

Can I create an electronic signature for signing my business information description in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your applicant business application and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit business information type on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign biographical affidavit naic on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is NAIC Biographical Affidavit?

The NAIC Biographical Affidavit is a form used by the National Association of Insurance Commissioners to collect biographical information about individuals seeking to become licensed insurance professionals or to hold certain positions within an insurance company.

Who is required to file NAIC Biographical Affidavit?

Individuals who are applying for a license to operate in the insurance industry, including executives, directors, and certain other key personnel, are typically required to file a NAIC Biographical Affidavit.

How to fill out NAIC Biographical Affidavit?

To fill out the NAIC Biographical Affidavit, applicants must provide required personal information, employment history, education details, and any legal disclosures as instructed. The form needs to be completed accurately and thoroughly.

What is the purpose of NAIC Biographical Affidavit?

The purpose of the NAIC Biographical Affidavit is to ensure that individuals in key positions in the insurance industry meet certain standards of character and competence, thereby safeguarding the integrity of the insurance system.

What information must be reported on NAIC Biographical Affidavit?

The NAIC Biographical Affidavit requires reporting of personal identification details, educational background, employment history, professional affiliations, and disclosure of any criminal history or regulatory actions, among other pertinent information.

Fill out your NAIC Biographical Affidavit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Naic Biographical Forms is not the form you're looking for?Search for another form here.

Keywords relevant to naic bio affidavit form

Related to naic biographical affidavit word

If you believe that this page should be taken down, please follow our DMCA take down process

here

.